Which aspects should entrepreneurs be aware of when they employ people in Indonesia? This blog aims to help employers and employees navigate their rights and obligations under Indonesian labour law. It explores the key points to be aware of before employing someone in Indonesia.

Companies’ Obligations to Employ a Foreigner.

- Administrative Process: To hire a foreigner in Indonesia, a company must comply with several obligations and administrative procedures. The company is generally required to employ a certain number of Indonesian citizens for each foreign employee hired (often a ratio of 1 foreigner to 5 Indonesian citizens, although this can vary).

- Apply and Submission of RPTKA: The company must submit the Expatriate Manpower Utilization Plan (RPTKA) to the Ministry of Manpower for approval to employ expatriates and follow prevailing procedures to obtain work and stay permits (IMTA). It is important to note that not all work positions are open to foreigners. Application for RPTKA is submitted via the Online Single Submission (OSS) platform.

- Obtaining the IMTA: Once the RPTKA is approved, the company applies for the IMTA. The employer must obtain a work permit (IMTA - Izin Mempekerjakan Tenaga Kerja Asing) for each foreign worker. This permit is issued by the Ministry of Manpower.

- Application for Temporary Work Visa (VITAS): After IMTA approval, the employee applies for a temporary work visa (VITAS) at the Indonesian embassy or consulate in their home country.

- Conversion of VITAS to KITAS: Upon arrival in Indonesia, the VITAS is converted to KITAS. The KITAS is issued to foreign nationals who want to work for an Indonesian company or organization. Work KITAS are typically valid for one year and can be renewed on an annual basis. To obtain a Working KITAS, the employer must obtain a working permit (IMTA) from the Indonesian Ministry of Manpower. The average cost of a Working KTIAS is IDR 30 M per person per year.

- Reports and Renewals: The company must regularly report on the use of foreign labour and renew permits and visas before they expire.

If you have questions regarding employing a foreigner in Indonesia, reach out to our legal team for further clarification:

Minimum Wage in Indonesia

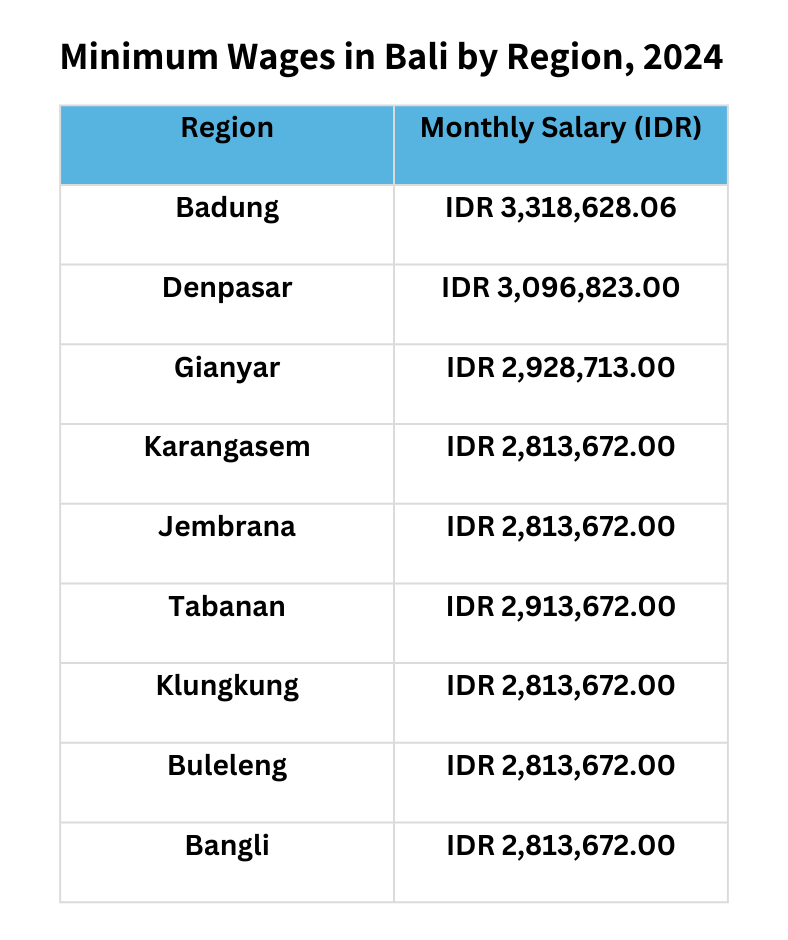

The minimum monthly wage for Indonesian workers in Bali is between IDR 2.8 M - 3.4 M, depending on the regency. Concerning foreign workers, the minimum monthly wage is IDR 8 M. Employers are required to withhold income tax monthly from the salaries and other compensation payable to their employees.

The minimum monthly salary for employees varies, depending on the regency the company is located. The current (2024) minimum wages in Bali are:

Monthly Salary Calculation

New regulations came into effect on 1 January 2024 to simplify the monthly calculation of withholding tax for the above types of income. GR-58 stipulates that the monthly calculation of withholding tax under Article 21 for the months of January to November must be made using an effective tax rate (ETR), and that the annual calculation made in December must always be made using the standard rate of progressive income tax under Article 21 governed by Article 17(1)(a) of the Income Tax Act.

- The final amount of unpaid tax will be based on the amount of the December recalculation, less the tax that was withheld from January through November. The ETR under GR-58 is applied to the gross income received by the individual in each month, without applying any annualization or deduction to the gross income.

The changes brought about by this regulation may alter the usual amount of employees’ net salary and result in a fluctuation in the payment of less or more tax in December. Employees should be carefully informed to ensure smooth implementation.

For questions or further clarification, our team can provide assistance. Contact us via email at contact@sasbali.com or through WhatsApp +62 821-9495-6032.

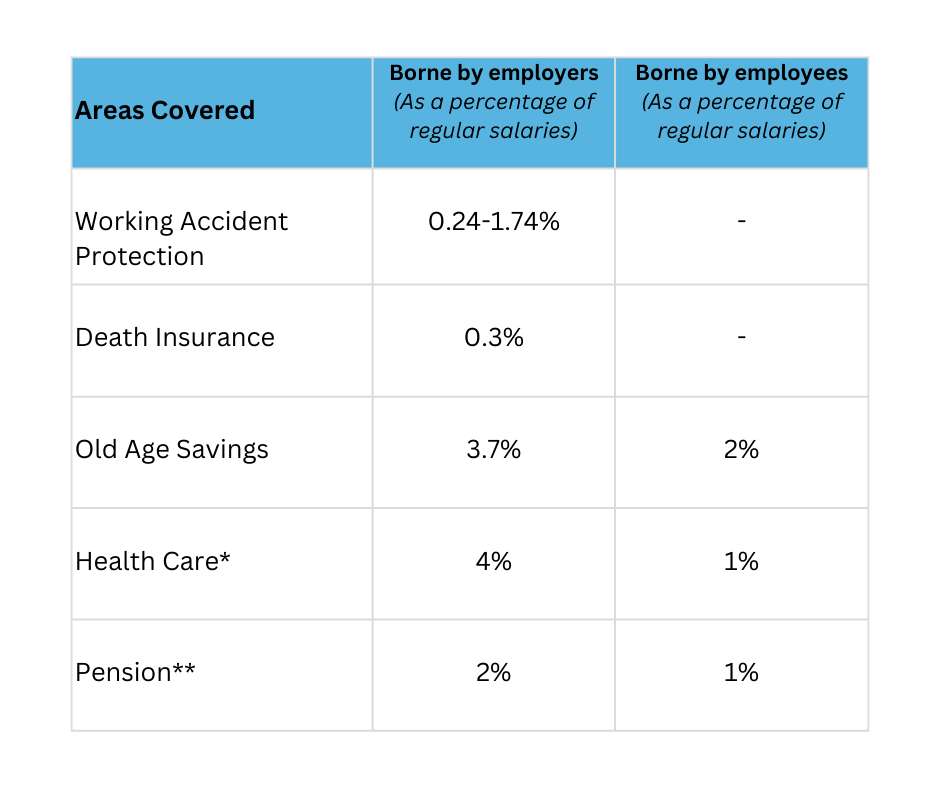

BPJS Kesehatan (Health Insurance) + BPJS Ketenagakerjaan (Social Security Insurance) = What are the BPJS rates?

BPJS is Indonesia’s social security system. It consists of two separate administrations. BPJS Kesehatan for health insurance and BPJS Ketenagakerjaan for accidents, pension, death, or life insurance, etc.

Employers are responsible for ensuring that their employees are covered by a social security program (BPJS). Employees’ contributions are collected by the employers through payroll deductions. These must be paid together with the employer’s contributions. The current premium contributions are as follows:

Employee Income Tax and BPJS Handling:

Employee Income Tax as well as BPJS can be handled differently. The company can decide if the Tax will be deducted from the employee’s salary or if the company will pay it. The same applies for the employee part of the BPJS, either it will be deducted from the employee’s salary, or the company bears it.

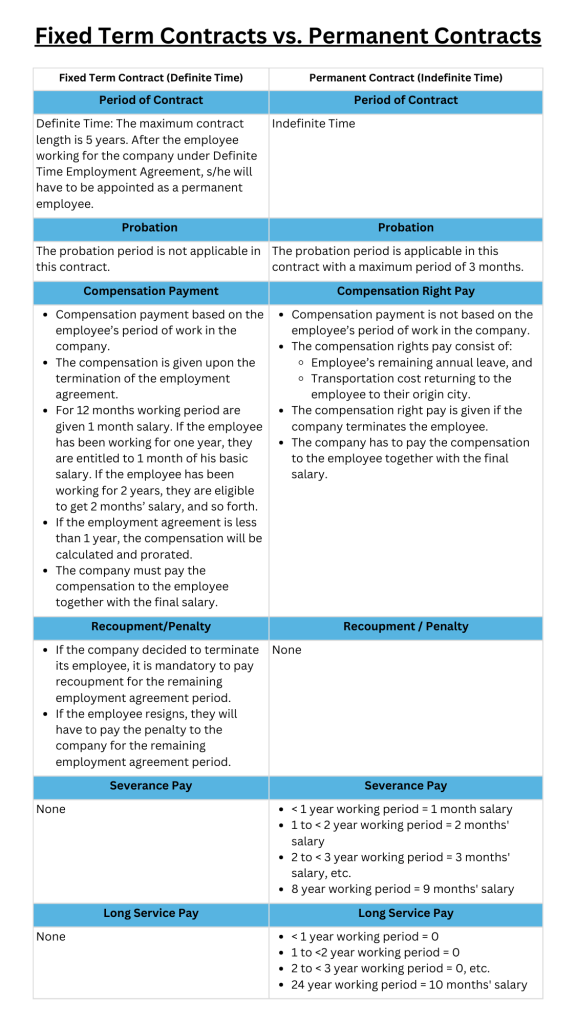

The Difference Between Fixed Term Contracts and Permanent Contracts

In Indonesia, employment contracts are governed by the Labour Law (Law No. 13 of 2003) and subsequent amendments. There are two main types of employment contract: fixed-term contracts (Perjanjian Kerja Waktu Tertentu or PKWT) and open-ended contracts (Perjanian Kerja Waktu Tidak Tertentu or PKWTT). The table below details the main differences between these two types of contracts:

In general, permanent employees enjoy greater protection, security, and rights under the law than fixed-term employees. This includes health insurance, retirement plans, or bonuses. Nevertheless, fixed-term contracts offer employers the flexibility to manage short-term needs, while open-ended contracts offer a degree of stability to both employers and employees.

Employers must ensure that they comply with regulations on the maximum duration and renewal of fixed-term contracts. Failure to do so may result in the contract being deemed permanent.

Conclusion

SAS specializes in providing comprehensive support and guidance to both employers and employees in Indonesia. With a deep understanding of Indonesian labour laws and regulations, we can help streamline the administrative process of hiring foreign workers.

Furthermore, SAS offers invaluable assistance with compliance matters, such as ensuring adherence to minimum wage requirements, tax regulations, and social security contributions. By leveraging their expertise and resources, employers can navigate these obligations with confidence, knowing that they are in full compliance with Indonesian labour laws.

Contact us today to learn more about our services, via email contact@sasbali.com or via WhatsApp +62 821-9495-6032