BKPM Regulation No. 5 of 2025: New PT PMA Capital Rules Explained

As an emerging or aspiring entrepreneur in Bali or elsewhere, understanding your company’s financial statements is crucial. These documents provide a clear picture of your business’s financial health. While accounting can seem complex, we at Smart Advisory Solutions are here to simplify it for you. Two of the most important financial statements are the Balance Sheet and the Income Statement (also known as a Profit & Loss Statement).

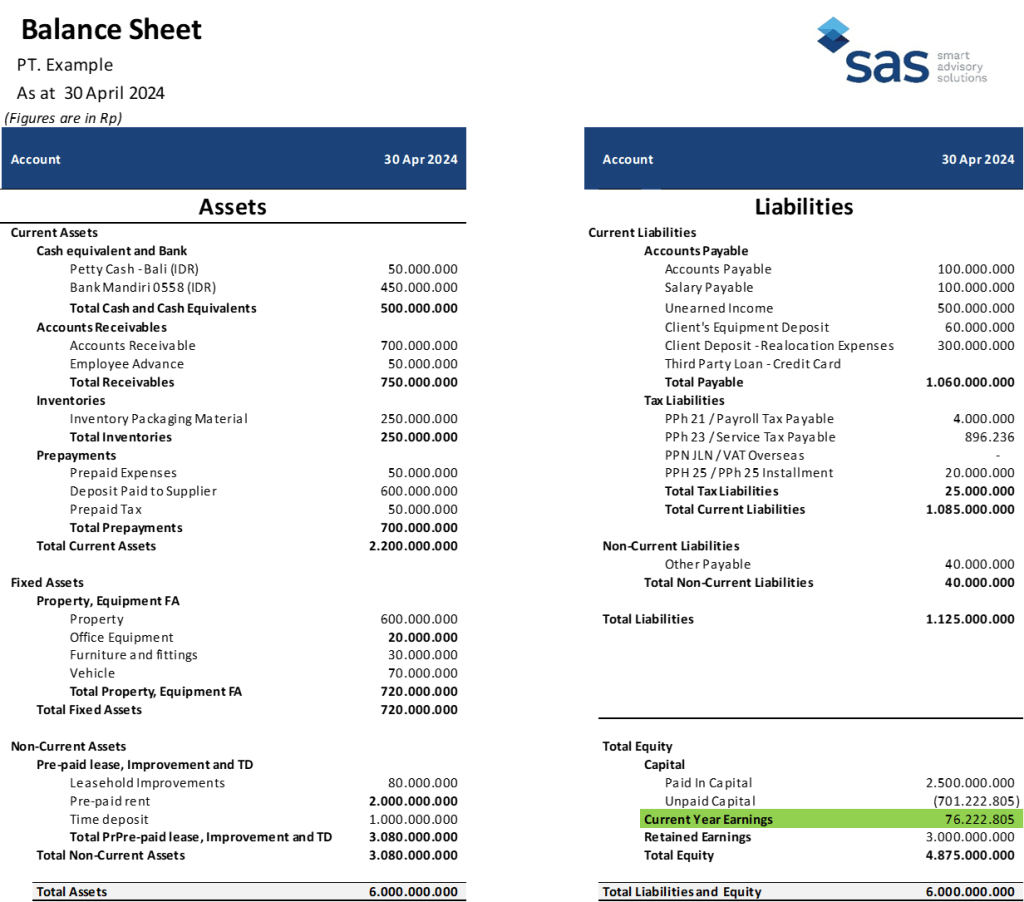

The Balance Sheet reflects the life of a company at a given point in time. It can be represented as a "snapshot" of a company's assets. It shows what it owns (assets) and what it owes (liabilities). The balance sheet reflects the company's economic and financial health. It is always in balance.

Below is an example of a company's Balance Sheet:

Assets

Located on the left side, assets represent all the resources and possessions of your company. These include:

Liabilities

On the right side, liabilities detail your company’s financial obligations. These are categorized into:

A fundamental principle of accounting is that assets must always equal liabilities and equity. This balance ensures that every financial transaction is accurately recorded, reflecting the origin and use of funds.

Understanding your Balance Sheet helps you make informed financial decisions and maintain rigorous accounting practices. For personalized advice and assistance in managing your Balance Sheet, reach out to our accounting team:

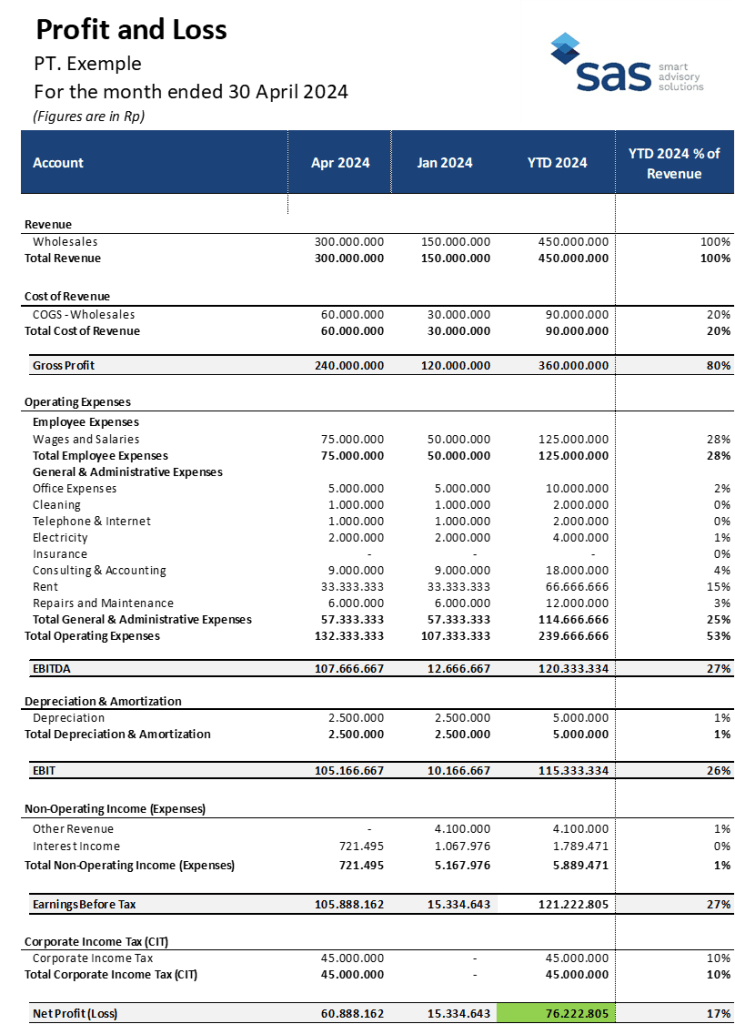

The Income Statement, also known as a Profit & Loss (P&L) Statement, provides a barometer of your company’s performance over a fiscal year. Unlike the Balance Sheet, the Income Statement can be compared to a video showing the company's income and expenses.

Here's an example of a company's P&L:

We divide the Income Statement into three main sections:

Operating Income & Expenses

This section reflects your company’s core activities. It shows the difference between sales revenue and the costs associated with those activities (e.g. Cost of Goods Sold, Marketing, General & Administrative Expenses). We also refer to the total of the Operating Income as EBIT, or Earnings Before Interest and Taxes.

Financial Income & Expenses

This section focuses on financial revenues (like interest earned) versus financial expenses (such as interest paid on loans). These incomes and expenses are not related to the ongoing operation of the business, but rather show that the company has multiple revenue streams, which can be a sign of financial health and risk management. Financial income contributes to the overall profitability of the company and helps stakeholders understand the company’s financial strategy and investment effectiveness.

Net Profit

The Net Profit line on an Income Statement, also known as the bottom line, shows the final measure of a company's profitability after accounting for all revenues and expenses. It is the amount of money that remains after deducting all operating expenses, interest, taxes, and other costs from the total revenue.

By understanding the Income Statement, you can better assess your company’s financial performance and identify areas for improvement.

Navigating the intricacies of accounting doesn’t have to be daunting. At Smart Advisory Solutions, we offer comprehensive accounting services to help you maintain financial clarity and drive your business forward. Contact us today to schedule a consultation and take the first step towards financial management.

BKPM Regulation No. 5 of 2025: New PT PMA Capital Rules Explained

A 2025 guide for foreigners on importing into Indonesia: company setup, KBLI selection, NIB/API licensing, customs, and compliance. Expert help from SAS.

Tunjangan Hari Raya (THR) is a mandatory religious holiday allowance in Indonesia. It is a key part of employee rights, ensuring workers receive extra financial support before major religious celebrations. Employers must understand their obligations to avoid legal consequences. What is THR in Indonesia? THR is a one-time annual payment given to employees before religious […]