BKPM Regulation No. 5 of 2025: New PT PMA Capital Rules Explained

Corporate Income Tax in Indonesia is a key aspect of running a business. Understanding tax rates, incentives, and deductions helps optimise tax obligations. This guide breaks down Indonesia’s corporate income tax structure, incentives for new companies, allowable deductions, and corporate income tax deadlines.

The fiscal year (or tax year) in Indonesia follows the calendar year, from the 1st of January to the 31st of December.

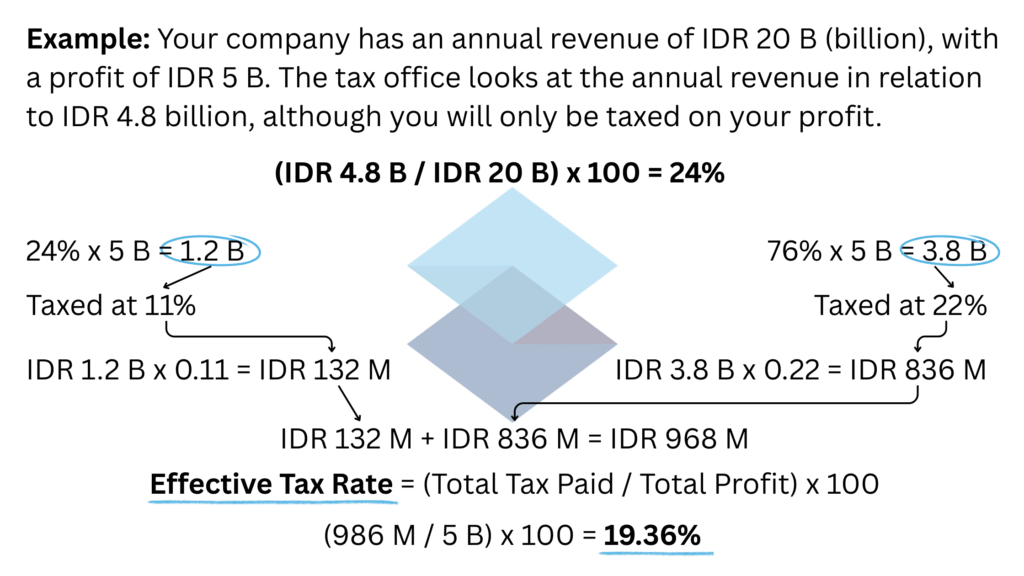

Indonesia’s standard corporate income tax rate is 22%. However, businesses may qualify for reduced rates. Small enterprises with an annual revenue below IDR 50 billion receive a 50% reduction on taxable income up to IDR 4.8 billion. Companies earning between IDR 4.8 billion and IDR 50 billion pay tax progressively, with effective rates between 11% and 22%.

To boost business growth, Indonesia offers tax incentives for new companies. For the first three (3) fiscal years, companies with turnover below IDR 4.8 billion can benefit from a 0.5% tax on gross revenue rather than net profits. However, this tax incentive has limitations:

Businesses anticipating substantial early-stage losses may choose to forego this tax incentive from the outset. This allows losses to be carried forward for up to five (5) years, offsetting future taxable income and reducing tax liability.

Businesses can lower taxable income by claiming various deductions. Cost of Goods Sold (COGS), general and administrative expenses, marketing, research and development, and other operating costs and deductible. Depreciation and amortization allow businesses to spread asset costs over their useful life. Bad debts can be deducted if properly documented, while interest expenses are allowed within these capitalization rules. Corporate Social Responsibility (CSR) expenses are deductible when linked to business activities.

Taxpayers must pay Monthly CIT Instalments (Article 25 Income Tax) based on the previous year’s tax return. They must make the payment by the 15th of the following month and file the tax return by the 20th.

The Annual Corporate Income Tax Return and Payment are due by the 30th of April of the following year. Late payments or filings may result in penalties and interest charges.

If a company overpays tax, it can apply for a refund or credit against future tax liabilities. However, such refund will trigger a tax audit.

Managing Corporate Income Tax in Indonesia requires strategic planning to ensure compliance while maximizing efficiency. At SAS, our expert tax advisors provide tailored solutions for businesses of all sizes. Contact us today to discuss your corporate tax strategy.

BKPM Regulation No. 5 of 2025: New PT PMA Capital Rules Explained

A 2025 guide for foreigners on importing into Indonesia: company setup, KBLI selection, NIB/API licensing, customs, and compliance. Expert help from SAS.

Tunjangan Hari Raya (THR) is a mandatory religious holiday allowance in Indonesia. It is a key part of employee rights, ensuring workers receive extra financial support before major religious celebrations. Employers must understand their obligations to avoid legal consequences. What is THR in Indonesia? THR is a one-time annual payment given to employees before religious […]