A 2025 guide for foreigners on importing into Indonesia: company setup, KBLI selection, NIB/API licensing, customs, and compliance. Expert help from SAS.

REID is Bali’s only independent data provider, and your home for property insights. We decode Bali’s property market with data-backed insights and sharp analytical clarity. Our platform serves property investors, developers, and professionals looking to make confident decisions based on real numbers, not hearsay. From market-wide analytics and custom reports to subscription dashboards and property appraisals, REID doesn't just track the market, we interpret it. Read below to discover some of the leading trends from the beginning of 2025 that are shaping the market.

The start of 2025 didn’t arrive with a bang but it did arrive with clarity. For anyone paying attention, Bali’s property market is no longer a free-for-all. It’s a redistribution. A quiet shift from momentum to maturity, with new development hotspots emerging in areas like South Badung and Mengwi, and growing investor interest in compact apartments and off-plan villas. The smart money isn’t chasing hype, it’s chasing scale, efficiency, and performance. And the data is drawing a clear line between legacy expectations and the factors shaping the market.

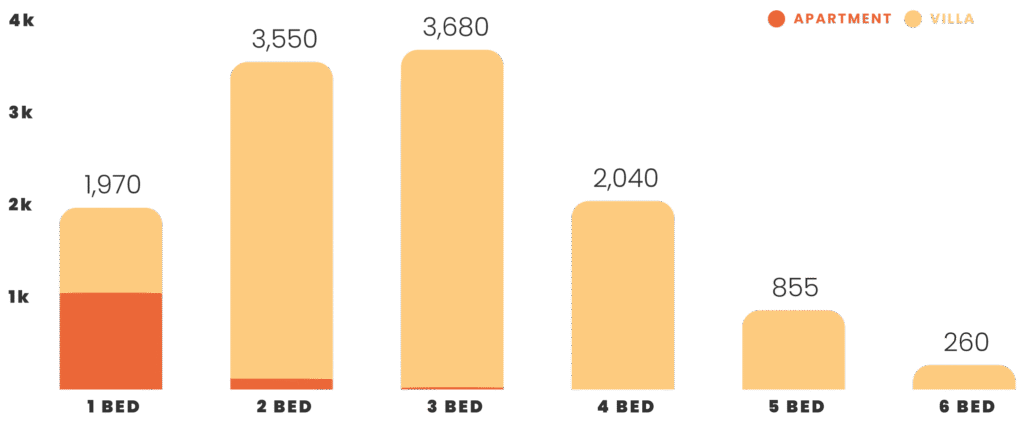

Gone are the days of sprawling villas as the default Bali property. One- and two-bedroom properties now dominate both listings and sales, and are having an impact on the shape of the real estate market; average build sizes shrunk 3.2% year-on-year. That’s not a design trend, that’s a redefinition of the market structure.

Sales volume tells the story clearly: combined, 1- and 2-bedroom assets made up over 62% of all transactions at the start of 2025. It’s a segment defined by movement, not hesitation. Price-wise, 1-bedroom properties traded at a median of USD $160,000 while 2-bedrooms held at USD $245,000, affordable entry points in a market where liquidity increasingly trumps luxury. Both of these sit below the market median of USD $298,000.

In a market where flexibility, rental yield, and resale potential matter more than ever, compact formats are the new default. They’re cheaper to build, easier to manage, and quicker to rent. The market now offers much more diversity in purchase options than it did 24 months ago, attracting more buyers and introducing more opportunities.

And it's not just about footprint. Lease terms on smaller assets now trend longer than the market average, a sign that these properties are not only fresh to the market, but also offer lasting returns not just short term flips. This is strategy, not speculation.

Off-plan properties now account for 37% of all listings within Bali, a 180% YoY increase. Developers are bullish and buyers are still showing up. But the balance is precarious. While the ratio of off-plan development sits within norms for a developing market, continued growth at this rate could tip the scales.

With price per square metre sitting well above that of completed stock, off-plan buyers are betting on future value and future delivery. If the pace of new listings continues to outstrip absorption, we’ll see more stress testing across the board. For now, it’s a vote of confidence. But confidence has a shelf life.

And let’s not pretend every off-plan buyer is walking into this with eyes wide open. For many, it's still an emotional buy dressed up in ROI projections. Still, the influx of capital and rising density in key zones show that developer appetite hasn’t waned. The challenge now lies in who delivers and who disappears into the noise.

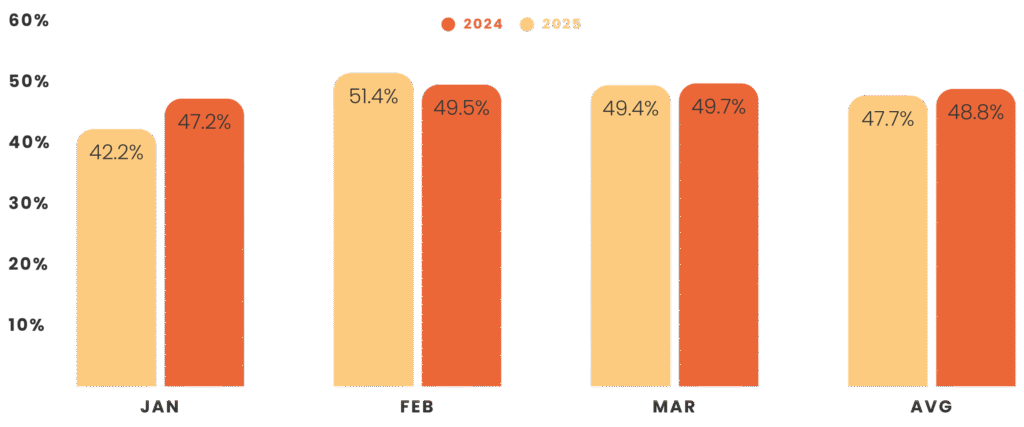

Occupancy is up 2.3% YoY. That’s the good news. The bad? Revenue’s down 16%. Whilst the start of the year is often the slowest period, rates have been sliding, each month at the start of 2025 saw more than a 12% drop. The pressure is heaviest on mid-sized stock, with three-bedroom properties and emerging areas like Mengwi taking the biggest hits.

The short-term rental space is getting crowded. More properties. More listings. Less pricing power. Owners banking on high nightly returns are waking up to a more sobering reality: volume doesn’t always equal velocity. The rapid growth of recent years must be understood against the backdrop of a global tourism sector still finding its footing after COVID. Bali recorded its strongest visitor numbers since 2019 throughout 2024, but the surge that followed the 2022 reopening is beginning to ease. Rather than a downturn, this reflects a return to the more measured, incremental growth that characterised the market pre-2020.

The silver lining? A 30% rise in professionally managed properties suggests owners are stepping up. Operational efficiency is no longer a nice-to-have. It’s a survival strategy. Expect more bundling of services, standardisation of guest experience, and sharper marketing as competition intensifies.

There are signs Bali’s property sector is finally stepping out of its adolescence. Lease terms are stabilising, supply is diversifying, and market participants are behaving increasingly cautiously and less speculative.

The changes in the market are clear; apartments alone now make up just under 12% of total supply, a small number, until you realise that’s a 56% YoY increase. These assets are denser, faster to market, and increasingly popular with budget-conscious investors. The dominance of villas isn’t disappearing, but it is being challenged.

Want to discover more? REID’s Location Reports give you granular, data-backed insights into Bali’s hottest submarkets. Understand zoning trends, pricing benchmarks, infrastructure shifts, and investor sentiment at the neighbourhood level.

Get 20% off your report using code “SASREPORTS25”.

Overall, developers are still building and investors are still buying. But the rules of the game have changed. Scale, timing, and asset type now matter more than glossy finishes and big promises. We’re seeing a diversification in property types and a pivot from passive returns to performance-driven ownership across the island. From romanticised lifestyle buys to measurable, managed investments.

Bali’s property market is maturing and filtering, and those who adapt are likely to uncover more opportunities than ever.

As Bali’s property market matures, so must investor behaviour. The shift from emotional buys to performance-driven investments demands more than just market data—it requires legal clarity. A property’s zoning, permits, land status, and ownership history can be the difference between opportunity and liability.

That’s where Smart Advisory Solutions (SAS) comes in. Our Legal and Tax Due Diligence service helps investors verify exactly what they’re buying—before signing, before building, before problems arise. Whether you’re acquiring off-plan, leasehold, or freehold assets, SAS ensures the legal foundation of your investment is as solid as your financial logic.

Smart decisions start with sharp data—and end with sound legal footing.

A 2025 guide for foreigners on importing into Indonesia: company setup, KBLI selection, NIB/API licensing, customs, and compliance. Expert help from SAS.

Tunjangan Hari Raya (THR) is a mandatory religious holiday allowance in Indonesia. It is a key part of employee rights, ensuring workers receive extra financial support before major religious celebrations. Employers must understand their obligations to avoid legal consequences. What is THR in Indonesia? THR is a one-time annual payment given to employees before religious […]

When hiring in Indonesia, companies must navigate specific employment laws to ensure compliance, particularly when it comes to employment contracts. Employers in Indonesia typically choose between Definite-Time Employment Contracts (PKWT) and Indefinite-Time Employment Contracts (PKWTT). Both contract types come with their own set of rules, advantages, and obligations. This guide offers an overview to help […]